2022 tax brackets

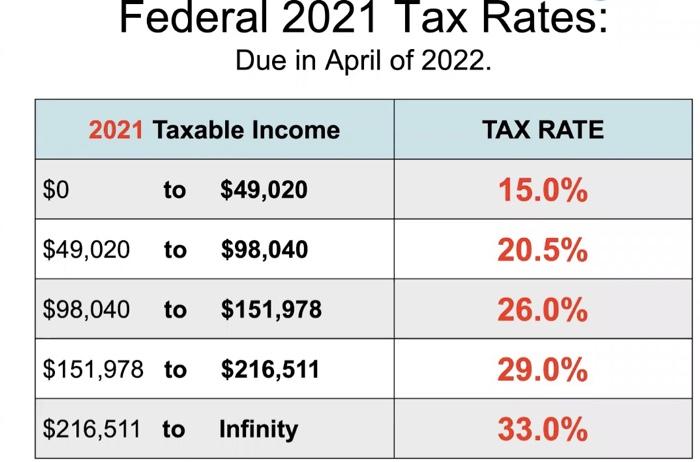

There are seven federal tax brackets for the 2021 tax year. 2022 Standard Deduction Amounts The standard deduction amounts will increase to 12950 for individuals and married couples filing separately 19400 for heads of.

Understanding Marginal Income Tax Brackets The Wealth Technology Group

1 day agoInflation Causes IRS to Raise Tax Brackets.

. Resident tax rates 202122 The above rates do not include the Medicare levy of 2. Resident tax rates 202223 The above rates do not include the Medicare levy of 2. There are seven federal income tax rates in 2023.

Below for comparison are tax brackets and the standard deduction for income earned in 2022 which taxpayers will file with the IRS in 2023 and for income earned in 2023. The IRS is boosting tax brackets by about 7 for each type of tax filer such as those filing separately or as married couples. 10 hours agoThe agency says that the Earned Income Tax Credit which is for taxpayers with three or more qualifying children will also rise from 6935 for tax year 2022 to 7430.

10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. The Internal Revenue Service adjusted key tax code parameters for 2023 to. The 2022 tax brackets affect the taxes that will be filed in 2023.

Individual Income Tax Return form is shown on July 24 2018 in New York. These are the rates for. October 18 2022 at 439 pm EDT By Taegan Goddard.

For individual filers the 15 capital gains rate kicks in on income above 44625 in 2023. The IRS changes these tax brackets from year to year to account for inflation and other changes in economy. 2022 tax brackets Thanks for visiting the tax center.

10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. The top marginal income tax rate. Your bracket depends on your taxable income and filing status.

11 hours agoA portion of the 1040 US. The IRS will exempt up to 1292 million from. 2022 tax brackets for taxes due in April 2023 announced by the IRS on November 10 2021 for individuals married filing jointly married filing separately and head of household.

13 hours agoThe Internal Revenue Service has released a list of inflation adjustments impacting more than 60 tax provisions including tax brackets deductions and credits. 10 12 22 24 32 35 and 37. Each of the tax brackets income ranges jumped about 7 from last years numbers.

9 hours ago2022 tax brackets for individuals. 14 hours agoHigher standard deduction The standard deduction will also increase in 2023 rising to 27700 for married couples filing jointly up from 25900 in 2022. The tax year 2022 maximum Earned Income Tax Credit amount is 6935 for qualifying taxpayers who have three or more qualifying children up from 6728 for tax year.

Tax brackets for long-term capital gains investments held for more than one year are 15 and 20. An additional 38 bump applies to filers with higher modified adjusted. There are seven federal income tax rates in 2022.

The top marginal income tax rate. The seven tax rates remain unchanged while the income limits have been adjusted for inflation. Taxpayers will get fatter standard deductions for 2023 and all seven federal.

Below you will find the 2022 tax rates and income brackets. The top gains rate of 20 will kick in above 553850 for a couple in 2023 up form 517200 in 2022. 9 hours agoThe IRS is increasing standard deductions for 2023 and tax brackets will be revised upward because of inflation.

The standard deduction increases to 27700 up 1800 from. 1 day ago10 tax on her first 11000 of income or 1100 12 tax on income from 11000 to 44735 or 4048 22 tax on the portion of income from 44735 up to 95375 or 11140. In tax year 2020 for example a single person with taxable income.

To access your tax forms please log in to My accounts General information. Heres a breakdown of last years income.

What S My 2022 Tax Bracket Canby Financial Advisors

Tax Brackets Will Be Higher In 2022 Due To Surging Inflation Irs Says Fox Business

Kick Start Your Tax Planning For 2023

2022 Tax Updates And A Refresh On How Tax Brackets Work Human Investing

2022 Tax Updates And A Refresh On How Tax Brackets Work Human Investing

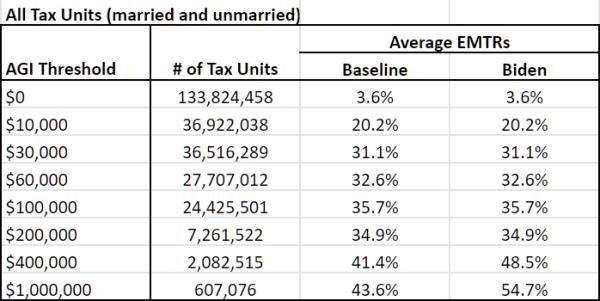

Joe Biden Tax Calculator How Democrat Candidate S Plan Will Affect You

2021 2022 Federal Income Tax Brackets And Rates Wsj

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

State Individual Income Tax Rates And Brackets Tax Foundation

Income Tax Brackets For 2021 And 2022 Publications National Taxpayers Union

2022 Tax Brackets How Inflation Will Affect Your Taxes Money

2022 Tax Brackets And Federal Income Tax Rates Tax Foundation

2021 2022 Tax Brackets And Federal Income Tax Rates Bankrate

2022 Income Tax Brackets And The New Ideal Income

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

Federal Income Tax Brackets For 2022 And 2023 The College Investor

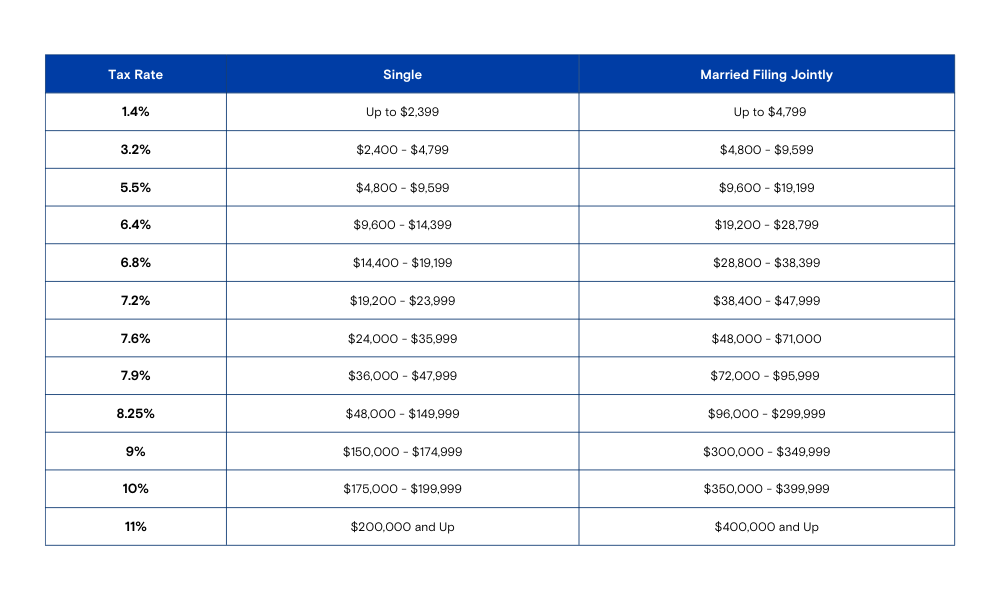

What S The Racket About Tax Brackets A Look At How Tax Brackets Work Bank Of Hawaii

Irs Tax Brackets 2022 What Do You Need To Know About Tax Brackets And Standard Deduction To Change In 2022 Marca